Coming to Terms - Balancing Payment and Saving Goals

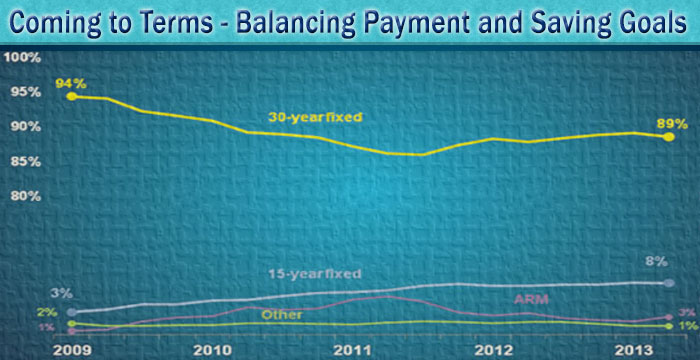

When calling around for interest rate quotes or visiting any number of mortgage websites, you’ll typically see two types of terms listed, a 30 year rate and a 15 year. By far, the 30 year mortgage is the most popular but coming in second is the 15 year loan. Which loan term is better for you?

There are more 30 year mortgages than 15 because they’re easier to qualify for. A 30 year mortgage payment will be lower than a 15 year. How much so? If you compare a 30 year rate of 3.75% and a 15 year rate of 3.50% on a $300,000 loan, the principal and interest payments are:

30 yr $1,389

15 yr $2,144

The 30 year loan payment is $755 lower than the 15 year mortgage even though the rate on the 15 year loan is lower. Yet the amount of interest paid over the life of the loan is considerably different. How much interest is paid over the full term of the loan?

30 yr $200,164

15 yr $ 86,036

That’s the tradeoff. Yes, the payments are lower but the amount of interest paid on a 30 year loan is $114,128 more and while 30 year mortgages rarely last for a full 30 years, the bulk of the mortgage payment goes toward interest, not principal and it takes longer to pay down the mortgage. On the other hand, the 15 year mortgage while saving significant interest is so much higher than a 30 year loan that borrowers find the payments are so high they can no longer qualify. So they revert to the 30 year note.

But there are other choices that many consumers may not yet be aware. Lenders offer alternative loan terms yet are often not advertised. Such terms are in five year increments of 10, 15, 20, 25 and 30 year terms. Now let’s take a look at the monthly payments along with the amount of interest paid using the very same $300,000 loan. The 30 and 25 year rates are 3.75%, the 20 year at 3.625% and the 15 and 10 year rate is 3.50%. Note, these rates will vary and are used for comparative purposes.

30 yr $1,389 $200,164

25 yr $1,542 $162,118

20 yr $1,759 $122,210

15 yr $2,144 $ 86,036

10 yr $3,001 $ 60,220

See the differences? It’s not necessarily a choice just between a 30 and 15 year loan. Ideally, there is a loan term that connects your goals of a low payment and saving on long term interest. Go ahead, talk to your loan officer and see what works best for you. You have more options than you might think.